Find Out Exactly How Succentrix Business Advisors Enhance Operational Effectiveness

Find Out Exactly How Succentrix Business Advisors Enhance Operational Effectiveness

Blog Article

Exactly How an Organization Accountancy Advisor Can Aid Your Business Thrive

In today's competitive company landscape, the know-how of a company accountancy expert can function as a crucial possession to your firm's success. By supplying customized monetary planning approaches and insightful capital monitoring techniques, these experts equip organizations to not just navigate intricacies yet likewise confiscate development chances. In addition, their proficiency in tax obligation optimization and threat management makes sure compliance and fosters a culture of informed decision-making. Yet, the full extent of their influence expands past these basics, revealing deeper understandings that can essentially transform your company trajectory. What might those insights require?

Financial Planning Techniques

Effective economic planning methods are vital for businesses aiming to accomplish long-term stability and development. These methods encompass a detailed method to handling funds, forecasting future revenues, and optimizing expenses. By developing clear economic goals, organizations can produce workable plans that line up with their total business objectives.

Key parts of effective financial preparation consist of capital budgeting, administration, and circumstance analysis. Money flow administration makes sure that organizations preserve sufficient liquidity to satisfy operational needs while likewise preparing for unexpected expenses. A well-structured budget plan functions as a roadmap for allocating resources successfully and monitoring financial performance. Circumstance analysis allows businesses to prepare for different market problems, aiding them to adjust their methods accordingly.

In addition, routine monetary reviews are important to assess the performance of preparation strategies and make necessary adjustments. Involving with a company bookkeeping consultant can improve this procedure, supplying competence in monetary modeling and risk assessment. By carrying out durable economic preparation methods, companies can navigate economic unpredictabilities, maximize growth opportunities, and ultimately protect their economic future.

Tax Optimization Methods

Tax obligation optimization methods play a crucial duty in boosting a business's general financial wellness. By strategically taking care of tax liabilities, firms can significantly boost their money flow and reinvest savings right into development chances. One efficient method is the cautious selection of company frameworks, such as S-Corporations or llcs, which can give tax obligation benefits based upon the details needs of the business.

Furthermore, making use of tax obligation credits and reductions is important. Organizations must on a regular basis review qualified deductions for expenditures like study and development, energy-efficient upgrades, and staff member training programs. Utilizing tax loss harvesting can likewise aid in countering gross income by offering underperforming assets.

In addition, applying a tax obligation deferral method permits businesses to postpone tax repayments, thus keeping funds for longer periods. This can be completed through retirement or investment accounts that supply tax obligation benefits.

Lastly, engaging with a knowledgeable company bookkeeping consultant can assist in the recognition of these chances and make certain compliance with ever-changing tax policies. By utilizing these methods, businesses can effectively reduce their tax concern and designate resources extra successfully toward achieving their tactical objectives.

Capital Monitoring

Cash circulation administration is important for keeping the monetary stability and operational performance of a service. It entails the surveillance, analysis, and optimization of money inflows and discharges to make sure that a business can fulfill its obligations while seeking growth chances. Reliable cash money circulation monitoring permits businesses to maintain liquidity, prevent unneeded financial debt, and prepare for future expenses.

A company bookkeeping expert plays a vital function in this process by offering specialist assistance on cash money flow cost, budgeting, and projecting management. They can help recognize fads in cash money circulation patterns, making it possible for services to make informed choices pertaining to expenses and financial investments. By implementing durable money management techniques, experts can aid in working out positive this link repayment terms with suppliers and maximizing receivables procedures to accelerate money inflow.

Additionally, an organization audit expert can offer insights into seasonal variations and cyclical patterns that may affect capital. This aggressive approach allows organizations to get ready for possible shortages and to take advantage of opportunities throughout height periods. On the whole, effective money flow administration, supported by a well-informed consultant, is important for making sure a business's lasting sustainability and success.

Efficiency Analysis and Reporting

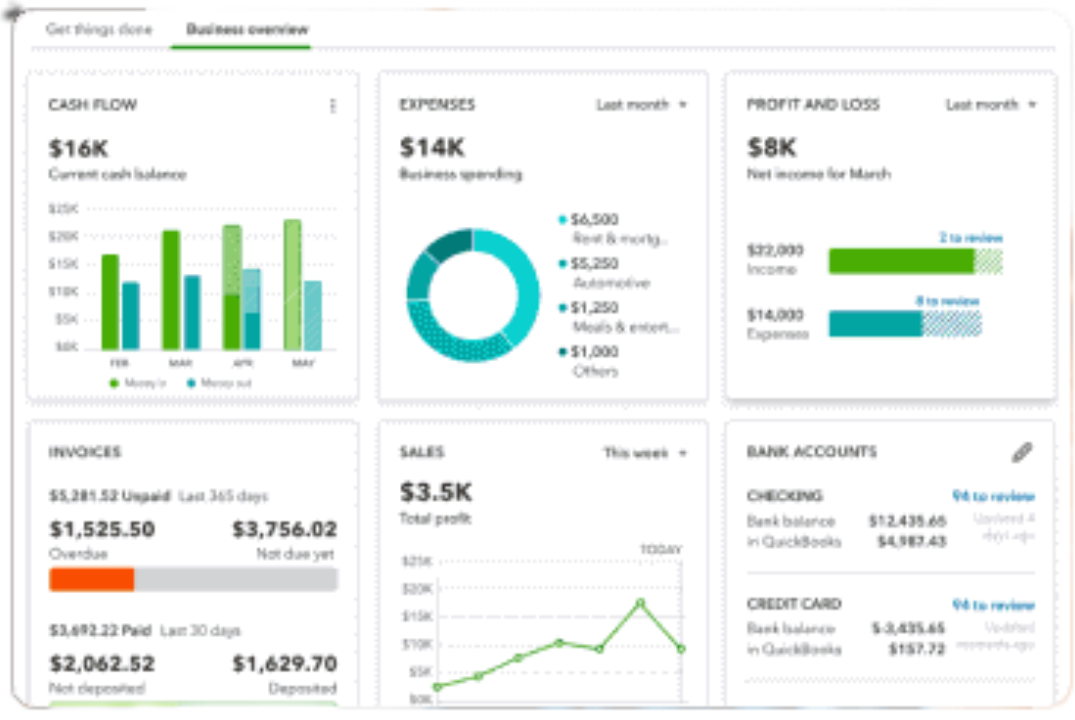

Performance analysis and reporting are important elements of tactical business administration, providing crucial understandings right into functional performance and monetary health and wellness. By systematically examining vital efficiency indications (KPIs), services can analyze their development toward objectives and determine locations calling for renovation. This analytic process makes it possible for business to comprehend their financial placement, consisting of expense, efficiency, and earnings management.

A business accountancy advisor plays a critical duty in this procedure, utilizing innovative logical devices and approaches to deliver accurate efficiency records. These records highlight trends, differences, and possible operational bottlenecks, enabling companies to make informed choices (Succentrix Business Advisors). The advisor can facilitate benchmarking versus sector requirements, which allows companies to gauge their efficiency loved one to rivals.

Routine performance reporting ensures that leadership is equipped with timely details to lead calculated planning and resource allocation. It fosters responsibility within groups and gives a framework for continuous improvement. By concentrating on data-driven understandings, business can enhance their functional methods and preserve an one-upmanship in the industry. Inevitably, effective performance evaluation and reporting empower companies to prosper by straightening their resources with their tactical goals and promoting sustainable development.

Danger Administration and Compliance

Although companies pursue development and earnings, they must additionally prioritize danger management and conformity to guard their operations and online reputation. Effective risk administration includes determining possible dangers-- financial, operational, or reputational-- and developing approaches to mitigate those threats. This proactive strategy allows services to navigate unpredictabilities the original source and shield their properties.

Compliance, on the various other hand, ensures adherence to regulations, guidelines, and market standards. Non-compliance can result in extreme penalties and damage to a business's reliability. A business audit consultant can play an important role in developing durable compliance frameworks customized to specific industry needs.

By performing regular audits and analyses, these experts help businesses identify conformity voids and implement corrective activities. They can help in developing internal controls and training programs that advertise a culture of compliance within the click here for more info organization.

Incorporating danger monitoring and compliance into the general business approach not just lessens potential disruptions however also enhances decision-making procedures. Eventually, the expertise of a company audit expert in these areas can cause sustainable growth and long-term success, ensuring that companies continue to be resilient in an ever-changing business landscape.

Conclusion

In verdict, the know-how of a company accountancy expert is critical in promoting organizational success. Inevitably, the calculated collaboration with a company bookkeeping advisor settings a company to capitalize on development chances while alleviating possible economic challenges.

In today's affordable company landscape, the know-how of a service bookkeeping advisor can serve as a pivotal asset to your business's success. Involving with a service bookkeeping expert can boost this procedure, providing know-how in economic modeling and threat evaluation - Succentrix Business Advisors. By carrying out durable financial preparation approaches, organizations can navigate financial unpredictabilities, take advantage of on growth possibilities, and ultimately protect their economic future

One reliable method is the careful option of service frameworks, such as S-Corporations or llcs, which can give tax obligation advantages based on the certain requirements of the organization.

Inevitably, the tactical collaboration with an organization bookkeeping advisor positions a company to take advantage of on development possibilities while reducing prospective monetary difficulties.

Report this page